Offshore Wind Challenges: Key Lessons for Philippine Energy Regulators

- July 12, 2025

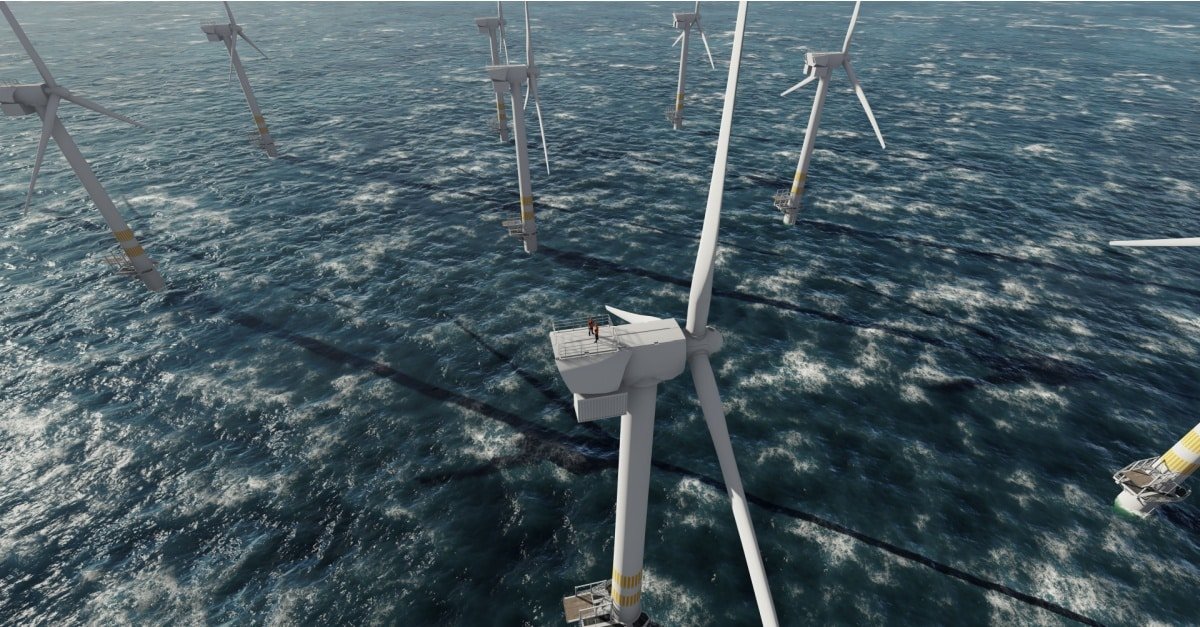

Offshore wind offers vast potential for clean energy generation, especially for archipelagic nations like the Philippines. However, international experience has shown that even mature markets are facing serious headwinds. Escalating expenses, stalled timelines, and shrinking financial backing have led to project delays and cancellations in major markets, like the US and Europe.

The average offshore wind price has surged to $230 per megawatt-hour (MWh)—over three times that of onshore wind—undermining commercial viability.

Moreover, industry players are pulling back. UK-based BP is weighing the sale of part of its offshore wind portfolio. Norway’s Equinor has exited planned ventures in Vietnam, Spain, and Portugal. Meanwhile, U.S. turbine manufacturer GE Vernova has halted new orders, signaling deep caution across the supply chain.

As of March 25, 2024, the Philippine Department of Energy reported awarding 92 offshore wind service contracts, representing a combined potential of over 65 gigawatts (GW). However, understanding current global setbacks is essential to building a resilient and competitive offshore wind industry at home.

(Also read: Is Offshore Wind Worth It? A Look at Its Pros & Cons)

What’s holding back offshore wind?

Despite its immense potential, offshore wind development faces a range of persistent challenges that continue to hinder its global progress.

-

Renegotiation of agreements

Developers worldwide are seeking to revise Power Purchase Agreements (PPAs) or Contracts for Difference (CfDs) due to cost inflation, interest rate hikes, and supply chain disruptions.

In the EU, these same pressures stalled progress. No offshore wind projects reached financial close in 2022, as turbine costs surged by 40% and a €180/MWh (approx. $195) price cap introduced revenue uncertainty, deterring investment.

Meanwhile, the U.S. offshore wind sector is under pressure. Inflation has pushed up construction expenses, while rising interest rates have made financing more expensive. As returns shrink, developers are pushing to revise or abandon fixed-price offtake agreements signed under very different economic conditions.

Spanish utility Iberdrola’s U.S. arm, Avangrid, recently paid $48.9 million to exit its power purchase deal for the planned Commonwealth Wind project in Massachusetts.

Over 9.7 GW of offshore wind capacity—more than half of all contracted projects across New York, Massachusetts, New Jersey, and Connecticut—are now flagged for potential renegotiation or termination. Major developers, including Shell-Ocean Winds, BP-Equinor, and Ørsted-Eversource, are all seeking to revise terms.

What the PH can do: Governments should offer feed-in tariffs or CfDs that reflect the true costs of building offshore wind farms, especially in places with unpredictable weather and global supply chain issues. For example, building typhoon-resistant turbines in the Philippines costs more than in calmer regions.

According to the Energy Transmissions Commission, contracts should “include price indexation in line with general inflation.” In the case of the US, where many offshore wind contracts don’t include price indexation, “general inflation and nominal interest rate rises can make already contracted projects uneconomic.”

-

Failed auctions

Several offshore wind auctions have collapsed as developers walked away, citing low price ceilings, rising costs, and poorly designed bidding rules.

In late 2024, the Danish Energy Agency launched a tender for 3 GW of offshore wind in the North Sea and received no bids. The auction required developers to cover seabed costs, offered no subsidies, and involved 20% state ownership—terms misaligned with current market costs and risk levels. Denmark’s climate minister directed the Energy Agency to consult industry players and investigate the lack of bids.

Additionally, the US administration scrapped a planned offshore wind lease auction off Oregon’s coast after the state’s governor withdrew support in 2024. It was the second cancelled sale that year, following a similar move in the Gulf of Mexico, as high costs and supply chain issues continued to stall the U.S. offshore wind rollout.

In 2022, the UK awarded nearly 7 GW of offshore wind contracts through CfDs. The record-low strike price of £37.35/MWh (about $47) soon proved unrealistic. By mid-2023, Vattenfall halted its 1.4 GW Boreas project, citing a 40% rise in costs. CfDs adjusted for inflation, but not enough to cover sharp spikes driven by the gas crisis. Other firms, like RWE, reported a similar cost increase of 20 to 40%.

In response, the government raised the maximum strike price by 66%, from £44 to £73/MWh (about $56 to $93) for offshore wind projects. As a result, the auction awarded 6.3 GW of new wind capacity, with approximately 5.3 GW designated specifically for offshore wind.

What the PH can do: Ensure auction pricing mirrors actual offshore wind expenses, not outdated assumptions. Avoid uncapped negative bidding, where developers pay instead of receiving support, as this can strain both the supply chain and consumers.

It also helps to test new auction formats through limited pilot rounds before scaling up. Private-sector stakeholders should be involved early to align auction rules with developer needs. In Europe, industry leaders urged governments to include safeguards in contracts to shield developers from cost spikes and prevent more projects from collapsing amid inflation.

-

Investor pullback

Offshore wind development has hit headwinds globally, as rising costs and policy uncertainty trigger a wave of investor pullbacks and stalled financing.

In 2023, Danish offshore wind giant Ørsted abandoned its Ocean Wind I and II projects off New Jersey, citing supply chain delays, soaring interest rates, and missed tax incentives. The company took a $4 billion hit and said the move was part of a broader effort to scale back exposure in the high-risk U.S. market.

Europe wasn’t immune to the offshore wind slowdown. In late 2024, Shell announced it would stop pursuing new offshore wind projects, citing unmanageable expenses and supply chain bottlenecks. Around the same time, Siemens Energy reported a €2.2 billion ($2.4 billion) loss tied to design flaws and unprofitable contracts.

With these setbacks, the offshore wind sector faces reduced competition, longer development timelines, and rising costs. Investor uncertainty is growing, and the sense of instability risks discouraging new players from entering the market.

What the PH can do: Maintain stable policies, simplify permitting, and offer targeted incentives to draw and keep global offshore wind investors. Clear, consistent regulation, especially in environmentally sensitive maritime zones, is essential to reduce risk and build long-term confidence.

Some countries now use “one-stop-shop” systems, placing all permits under one authority to cut delays and streamline approvals. In 2024, U.S. regulators revised offshore wind rules to reduce permitting delays, dropping the requirement for extensive use of meteorological buoys and allowing more flexible survey methods, while simplifying design and installation approvals.

(Also read: Too Soon to Go Green? Why Rushing into Renewables May Not Work)

Conclusion

While the Philippines has made strong initial moves by awarding over 90 service contracts, the true test lies in execution. Navigating rising costs, regulatory complexity, and investor hesitancy will require adaptable, evidence-based policymaking.

The Global Wind Energy Council (GWEC) noted that despite increased global wind capacity, some markets have become less stable for investors, with policy uncertainty on the rise. It stressed the urgent need to improve permitting systems, upgrade transmission infrastructure, and refine auction frameworks to support growing volumes of renewable energy.

As the Philippines scales up, it must treat offshore wind as a high-potential industry that demands tailored support. That means linking auction design with real-time cost data, safeguarding developers from inflationary shocks, and ensuring that policies evolve alongside market realities.

Done right, offshore wind can deliver not only energy security but long-term economic and environmental benefits for the country.

Sources:

https://www.slaughterandmay.com/insights/importedcontent/a-wake-up-call-for-uk-offshore-wind

https://www.ft.com/content/721c8c1c-9e27-4b32-af16-03d759b1d1a5

https://www.reuters.com/business/energy/new-wind-capacity-falls-short-despite-reaching-record-industry-body-says-2025-04-23