PH Power Transformation to be Driven by Key Stakeholder Priorities

- July 10, 2024

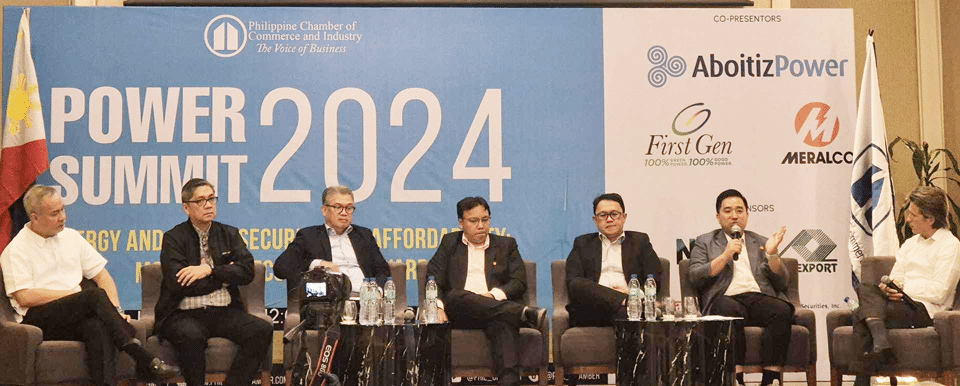

Key leaders in the Philippine energy sector came together at the Power Summit 2024 hosted by the Philippine Chamber of Commerce to discuss their respective priorities for the country’s energy transition.

The panel, entitled Perspectives of Industry Stakeholders and moderated by Carlos Aboitiz, Chief Corporate Services Officer of Aboitiz Power Corporation (AboitizPower), featured representatives from the generation, transmission, distribution, and retail electricity supplier (RES) segments.

Public-Private Partnership

Emphasis was placed by these industry leaders on the crucial role of clear and fair government policies and regulations in creating an environment that fosters certainty for investors.

The panel discussion commenced with addresses from Department of Energy (DOE) Secretary Raphael P.M. Lotilla and Energy Regulatory Commission (ERC) Chairperson Atty. Monalisa Dimalanta. Both emphasized the significance of effectively regulating and guiding the electrical power sector, given its widespread impact across various segments of the economy.

Lotilla noted how crucial it is for the government to collaborate with the private sector, particularly in the context of an energy sector that is predominantly private-driven. He said, “All the risks are with the private sector, and therefore we have to take into account what if later on there are changes in the regulatory regime, not only in the domestic market, but [also] externally.”

Priority Investments

Aboitiz acknowledged the necessary risks to be taken by private stakeholders in terms of investing in new generation capacities and emerging technologies. “The capital intensity of the industry [highlights] the importance of orchestrating and creating an environment of certainty for investors,” he said.

First Gen Energy Solutions Inc. President and COO, Francis Giles Puno, stressed the immense scale of investments required. “If you look at the Philippine Energy Plan, the amount of investments needed is significant. First Gen’s balance sheet cannot do it all alone. AboitizPower’s balance sheet cannot do it all alone,” he shared. This underscores the importance of collaborative efforts and partnerships across the electricity value chain to drive the necessary transformation and growth.

The Philippine Energy Plan 2020-2040 (PEP) forecasts a capacity addition of 92.3 gigawatts of renewable energy projects by 2040 under a Clean Energy Scenario, which will require a staggering investment of Php 5.8 trillion. Fortunately, there has been recent recognition of the favorable investment climate in the Philippines by several sources.

The plan envisions a substantial increase in the share of renewable energy in the power generation mix, aiming for a 35% and 50% share by 2030 and 2040, respectively.

According to the PEP, the DOE recognizes the capital-intensive nature of the energy sector and is seeking to actively engage the private sector and foster public-private partnerships to secure the necessary investments.

Adequate Transmission Infrastructure

Speaking on behalf of the transmission segment, the National Grid Corporation of the Philippines (NGCP) has made it a priority to complete all the required transmission facilities to ensure that every planned power plant project can be seamlessly integrated into the grid.

However, the agency also shared the “chicken or the egg” situation it finds itself in, as the question of whether to prioritize building power lines or power plants is a constant challenge for the industry. NGCP’s recommendation is for the ERC to allow them to build the transmission foundation in identified high-resource areas for renewable energy, even if power plant projects are still in the indicative stages.

“In our experience, in the third regulatory period, the ERC allowed us to implement transmission projects if the power plants are committed,” shared Red Remoroza, NGCP AVP and Head of Transmission Planning, adding, “But the plant won’t become committed if there are some uncertainties [on whether] the lines will be available.”

Support for Innovations

Meanwhile, Meralco prioritizes providing reliable service at the lowest cost, while also supporting innovations like solar rooftops and net metering.

As Meralco VP and Head of Utility Economics Lawrence Fernandez notes, “We have to adjust and learn to accommodate innovations [like] solar rooftops.” He added, “We’re now seeing even end-users injecting power back to the grid, making the distribution system more complex.”

According to the Meralco executive, these customer-generated power sources introduce complexity, requiring close collaboration with stakeholders and policymakers.

Customized Solutions

For the RES segment, the goal is to offer competitive, customized solutions to large electricity end-users who can choose their electricity provider. These are also called contestable customers. This goal aligns with the spirit of the Electric Power Industry Reform Act or EPIRA, which aims to foster a competitive electricity market.

“The retail sector does not hold any tangible assets per se, compared to a generator, the transmission operator, or a distribution utility. The bulk of our activity is service to the end-users,” stated Raymond Roseus, President of the Retail Electricity Suppliers Association of the Philippines. “We structure supply contracts that tailor-fit your requirement and we give it to you at a competitive rate.”

Source: Investments and transmission lines among top priorities of the PH power sector